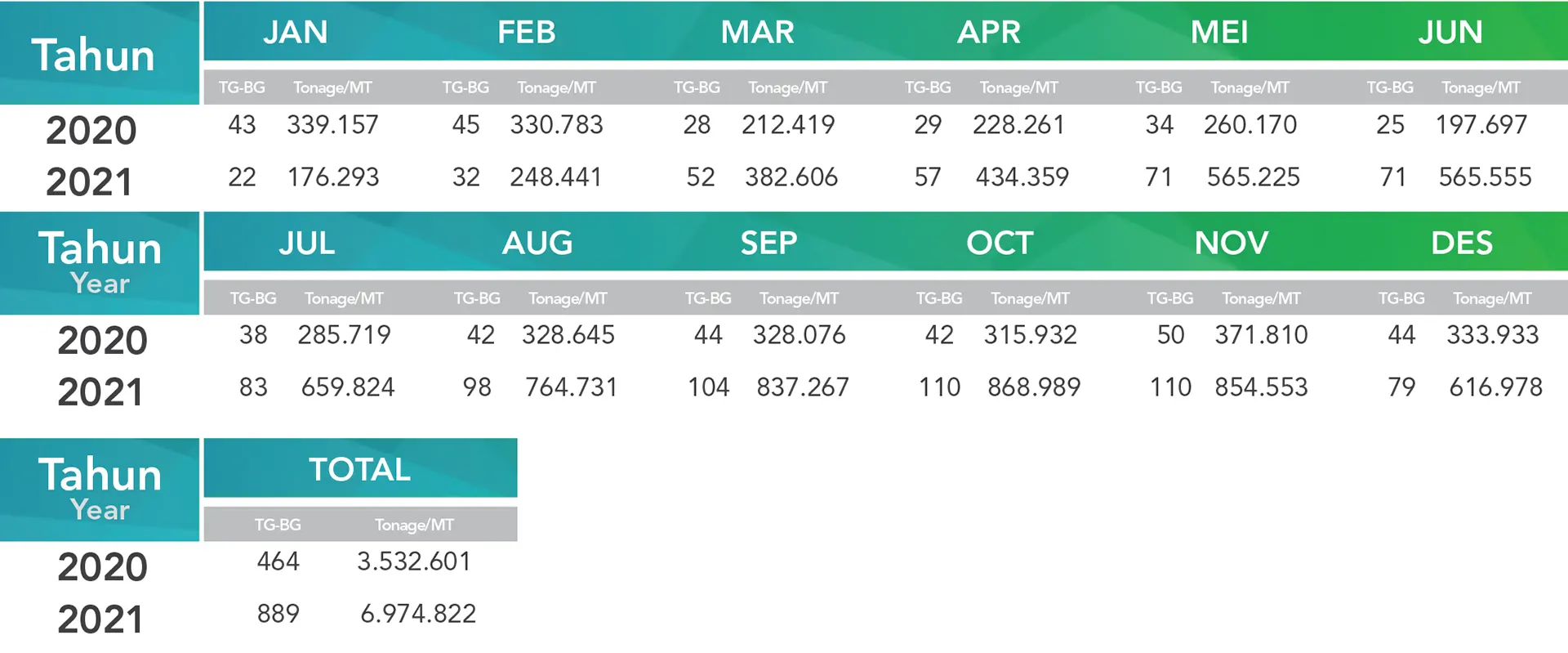

In 2021, the Company recorded a Barging Volume Recapitulation amounting to 6,974,821 M/T. There was an increase of 3,442,220 M/T from the previous year which was only 3,532,601 M/T.

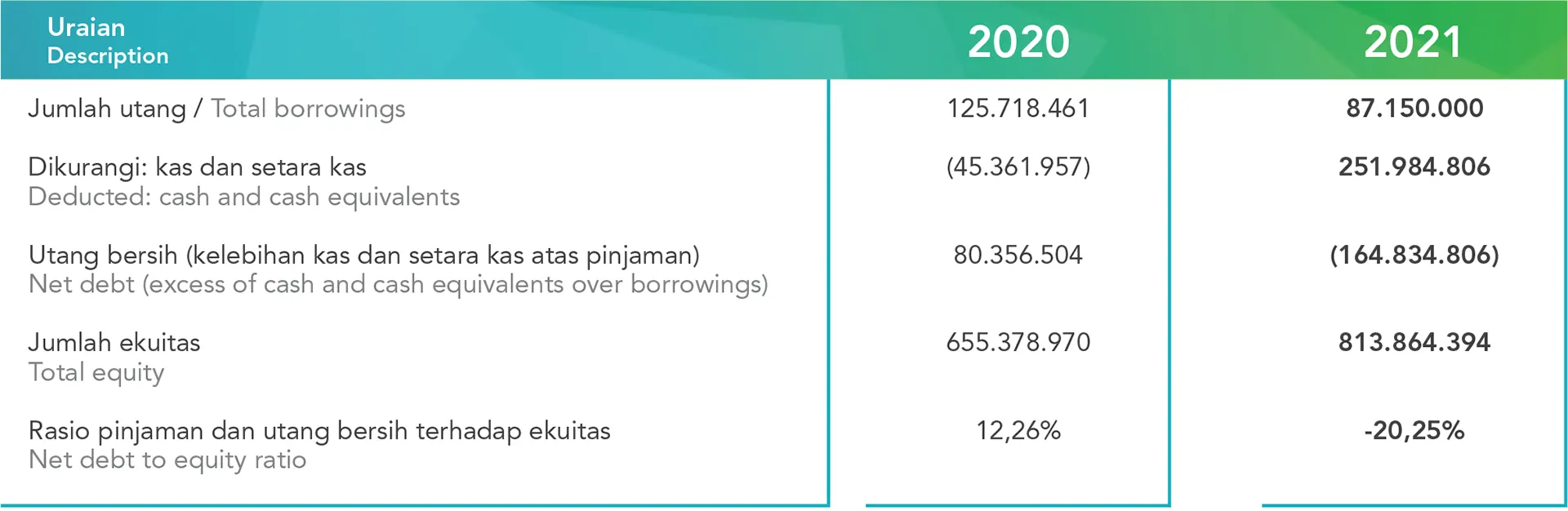

The Company manages and makes adjustments to its capital structure according to economic dynamics. The Company asses the capital using gearing ratio analysis (ratio of debt to equity) by dividing net debt to total capital.

Coal will still be a source of energy for electricity generation and industry. Domestic coal demand can be maintained due to the Domestic Market Obligation (DMO) policy.

The coal DMO policy is stated in the 2006 Presidential Decree concerning the National Energy Policy which stipulates that by 2025, coal will contribute 35% of the national energy mix. Various regulations also contain this policy.

The coal DMO is regulated to prevent coal supply shortages to ensure coal supply for sustainable domestic energy purposes. That is why every national coal mining company is required to sell 25% of its production at a price set by the Government to domestic coal users. The application of this DMO is related to fulfill the national electricity supply target of 35,000 Mega Watts.

DMO can increase the amount of coal production in the concession area around the operating area of the Company’s Subsidiary. The area requires transportation access to the port using roads owned by the Subsidiary. This will increase the Company’s profitability.

As a consideration for the future, the Company will focus more on running the infrastructure business through its subsidiaries and is committed to always providing the best service to coal producers in South Kalimantan.

The Company has projected the target for 2021 in the previous year. The following table compares the projections at the early projection in book with achieved operational performance result:

Statement of The Use of Initial Public Offering Fund per December 31, 2021